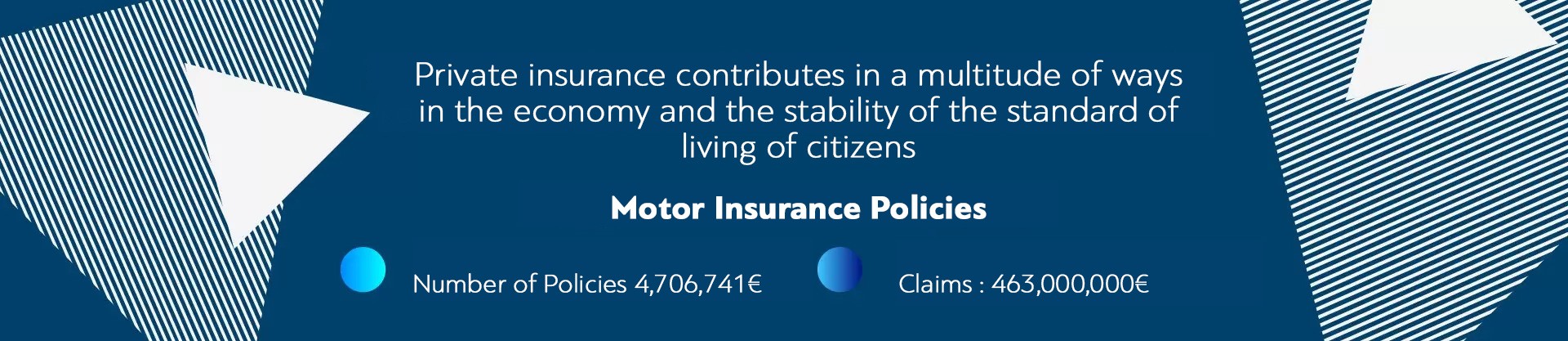

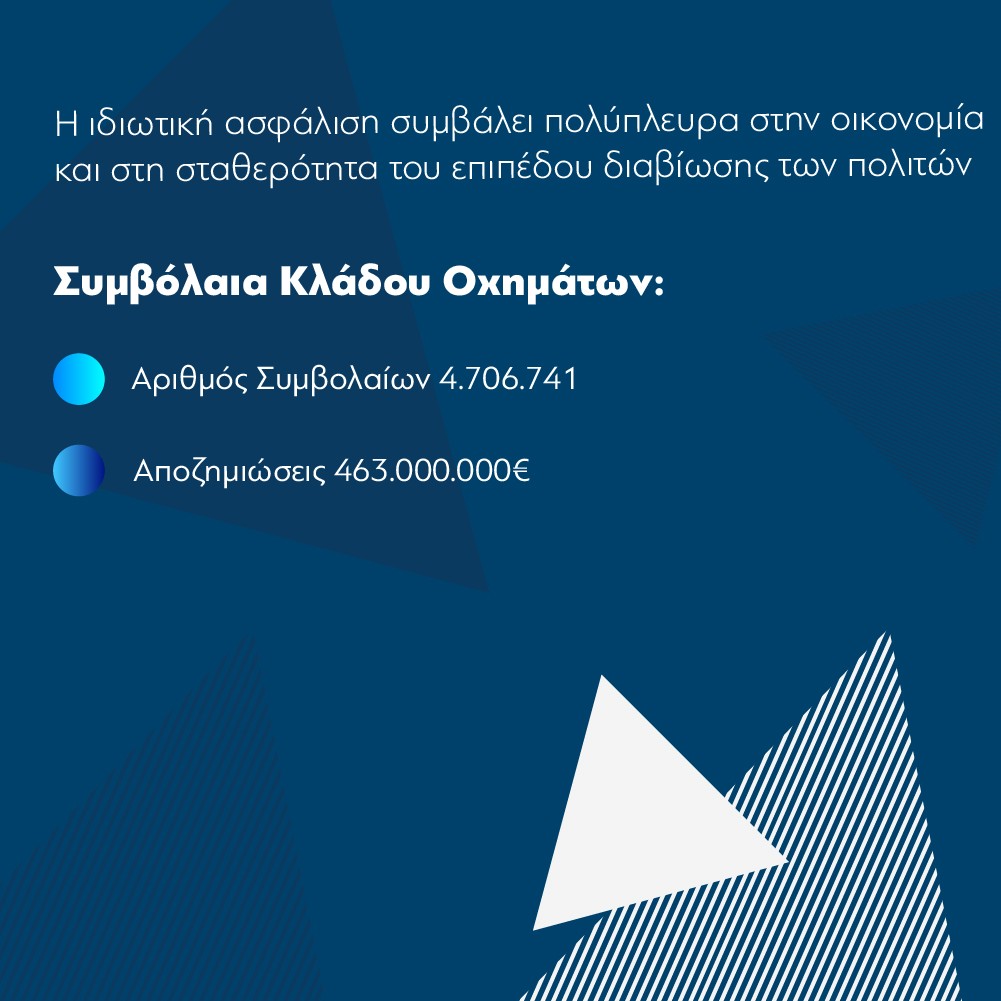

Motor Liability insurance – in addition to being mandatory – is an act of liability to society, as it covers significant financial burdens arising from road accidents. According to the law, the thresholds in insurance coverage are set at 1,300,000 euros per victim for bodily harm and respectively also at 1,300,000 euros for property damage, per accident regardless of the number of victims. What does this mean in practice?

In case someone hits you while driving and it is his fault then you will be compensated, get re-imbursed for the damages to your vehicle and in case of injury, also for your treatment. Conversely, if you cause an accident and you are in fault, those who have suffered damage will be compensated. And this is extremely important since the consequences of an accident can completely upset the budget and daily life of a family, especially in cases in which there are seriously injured or people end up with partial or total disability.

In cases where an uninsured driver is at fault, in addition to the sanctions and penalties imposed by law, victims cannot be compensated. They can initiate their compensation procedure through the Motor Auxiliary Fund, but they are not compensated immediately, with all that this may mean for their standard of living and in some cases for the restoration of their health.

In addition to the compulsory Motor Liability insurance required by the current legal framework, you have the option of additional coverage that enhances the protection of both you and your vehicle: